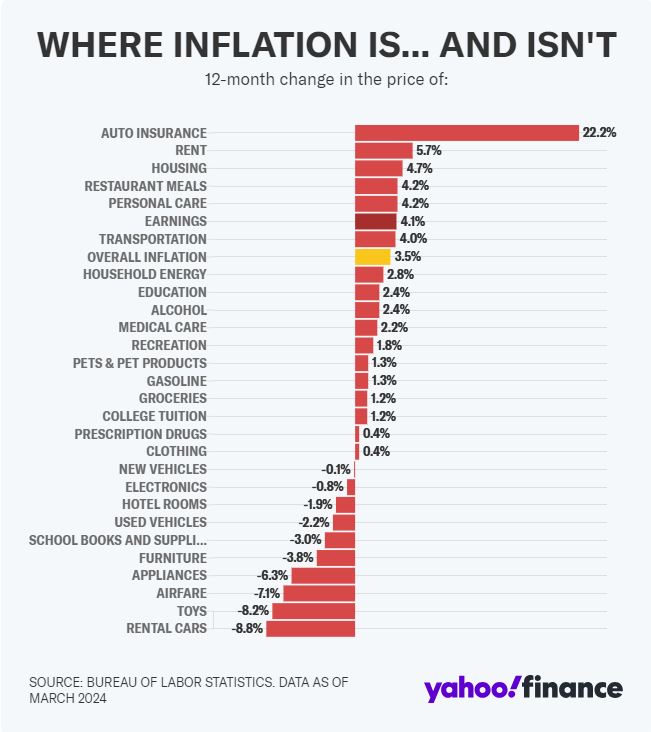

The auto and home insurance industry has seen inflation of over 20% in the last 12 months. Our team i working hard on minimizing this affect with our clients. We understand that these price adjustments can be difficult to fit into your budget, and our natural intuit is to shop for insurance.

Our agency’s priority is to provide comprehensive coverage at a competitive rate. We want to make sure when the unexpected occurs your policy will be there. Sometimes the age-old adage is true: “you get what you pay for.”

We have many clients who receive quotes from other companies that appear to be less expensive. Once we reviewed the policy, we found many of the hidden coverages were missing, and once they were added back on the policy it was more expensive.

Our industry does a poor job of showing all the coverages on a homeowner’s policy. We see competitors simply show the same dwelling amount, but what is actually covered by that dwelling amount can be completely different.

Here are some of the missing homeowner insurance additions that can cause a lack of coverage at claim time.

- Enhanced Replacement Cost

- Open Peril Coverage on Contents

- Ordinance & Law Coverage

- Water Backup Coverage

- Earthquake

- Hidden water damage

- Roof Replacement Cost

- Libel, Slander, Defamation of character

- Service Line Coverage

- Percentage Deductibles for Wind/Hail

All Insurance Companies are NOT the same at claim time. The state department of insurance and the National Association of Insurance Commissioners can tell you which companies have the fewest complaints and resolve them effectivel.

If you do choose to evaluate options, we ask you to allow us to compare the proposal. We will provide an honest comparison. We will also look up your insurance carrier on the NAIC website to review claim complaints.

Thank you for your business as we work to navigate this ever-changing insurance marketplace.