Inflation

Here are some key items that are affecting Home, Auto & Business Insurance.

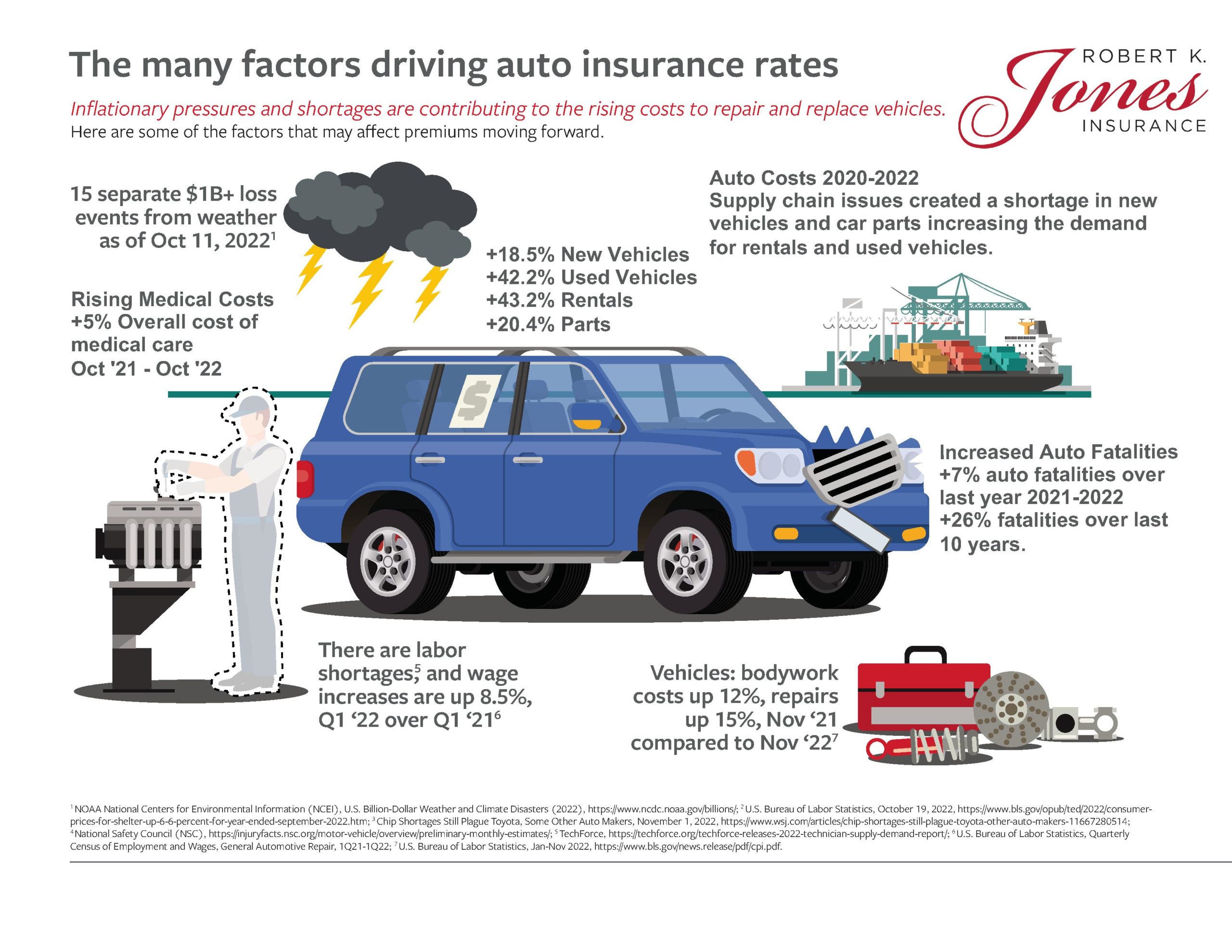

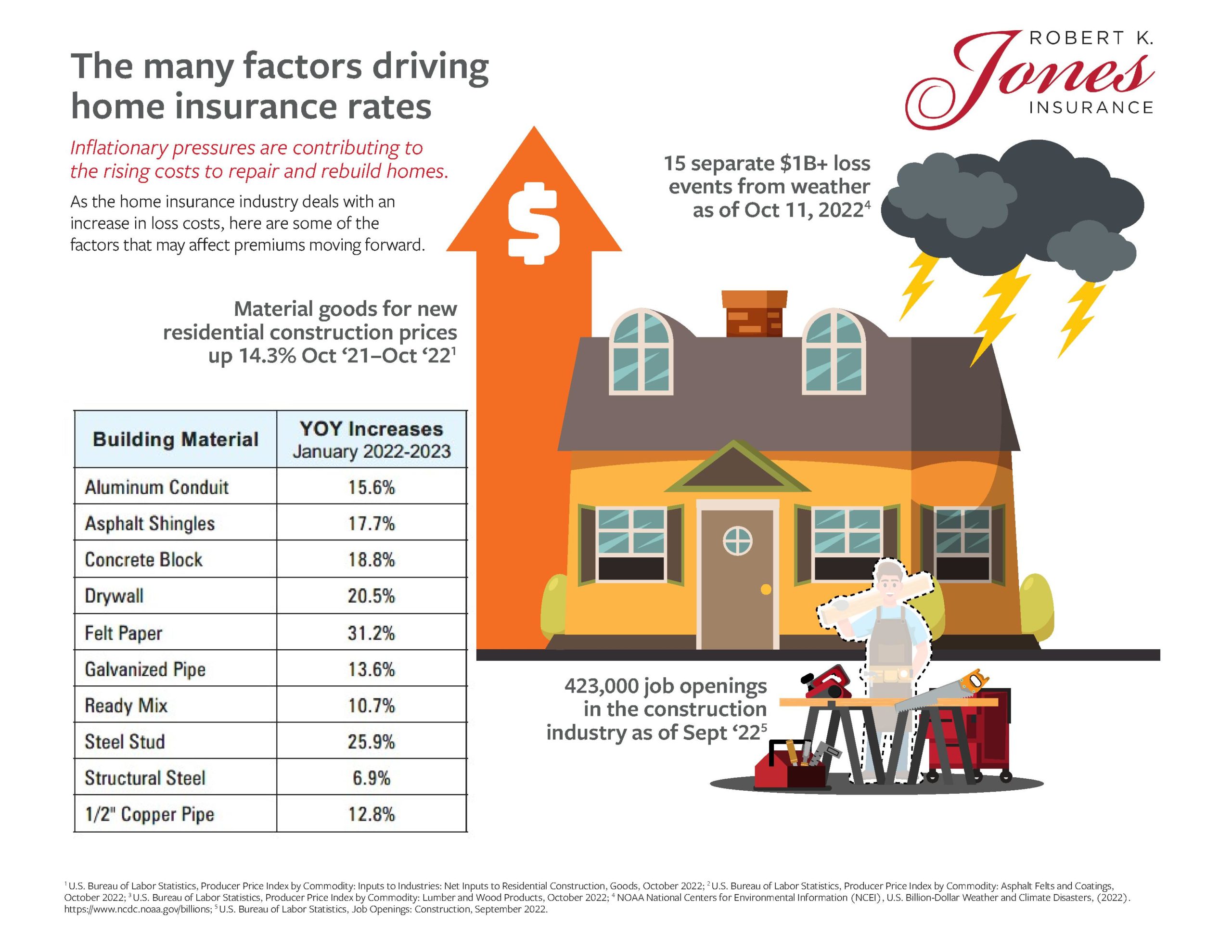

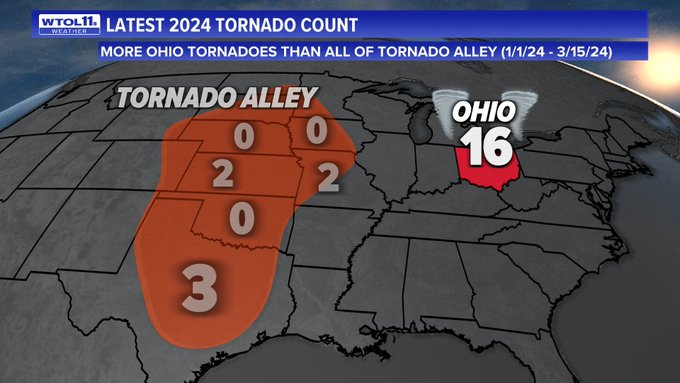

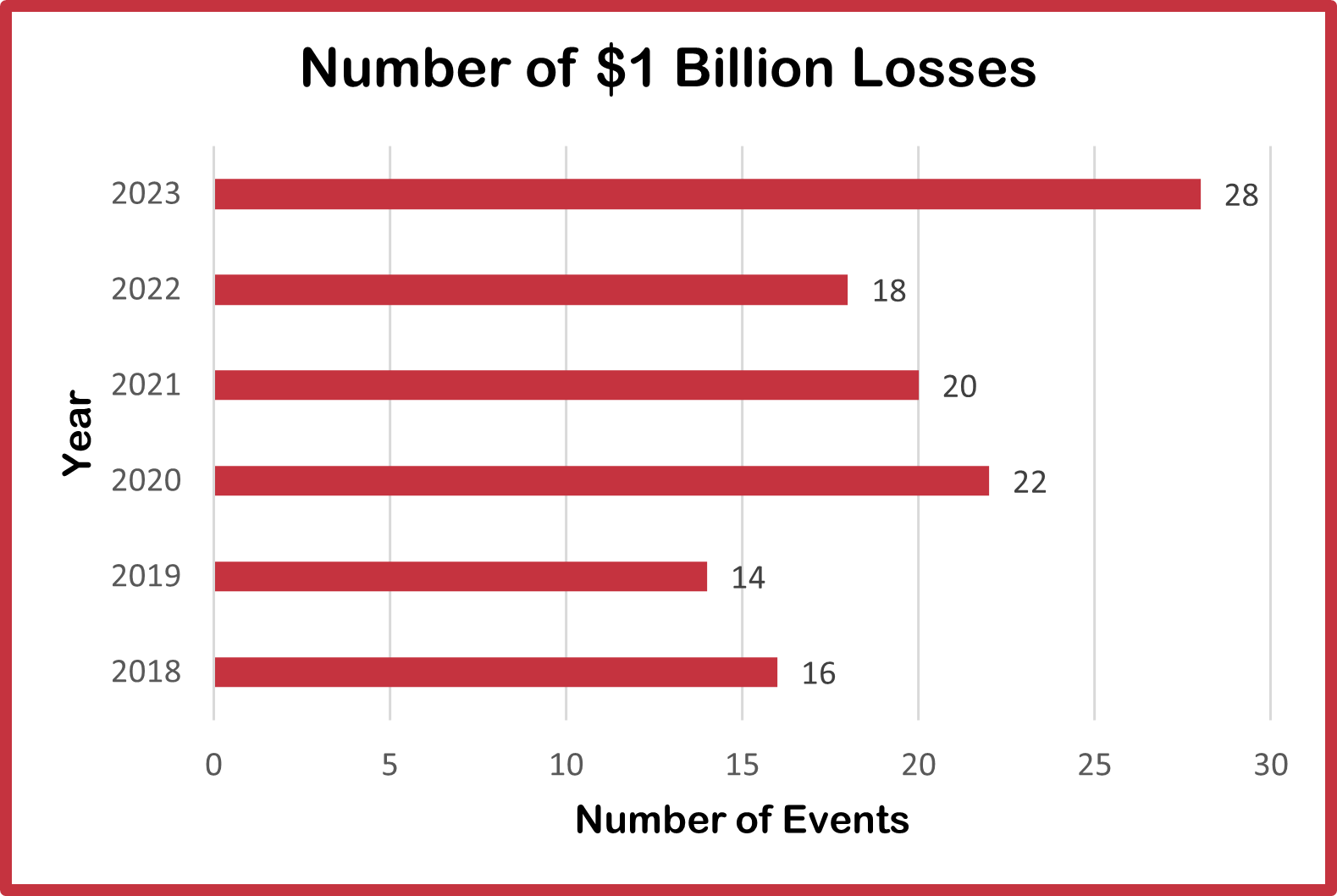

Weather and climate disasters are a major reason for Home, Auto & Business Insurance increases.

This picture to the left highlights that tornado activity is shifting east. Ohio has experienced more than double the amount of tornados compared to Tornado Valley as of March 2024.

Posted on X (formerly known as Twitter) by Chris Vickers, who is the chief meteorologist at WTOL in Toledo, OH.

The graph to the right highlights the past 5 years, which has an average of 18 (CPI adjusted) events.

In 2023 there were 28 weather and cliamte disasters have been recorded, which include 4 floods, 19 severe storms, 2 tropical cyclone, 1 wildfire, 1 drought, and 1 winter storm. Each of these events exceeding $1 billion losses. Each of these events exceeding $1 billion losses.

From 1980 to 2022 the average recorded weather and climate disaters recorded is 8 (CPI-adjusted) events.

Click the link below for more information: National Centers for Environmental Informaiton

This is not an attempt for you to feel sorry for the insurance company, but we are simply trying to explain why rates are increasing.

- CPI has increased 13.9% from 01/2021 – 12/31/2022, compared to historical 2% 10 year average

- Construction Costs have increased over 14% on average.

- Intensifying weather events. Average weather costs have doubled in the last 10 years. https://www.usatoday.com/story/news/nation/2023/09/11/us-sets-record-weather-climate-disasters-2023/70822661007/

- High nuclear claims ($1 Mil+) have increased drastically. Organizations are now investing in Third Part Litigation Funding where people invest in lawsuits, which are ultimately paid by policyholders. https://www.ncei.noaa.gov/access/billions/

- Reinsurance Premiums have increased 37+%, meaning insurers are now on the hook for more claims when a disaster strikes. https://finance.yahoo.com/news/drivers-squeezed-auto-insurance-costs-004453004.html

- Auto Insurance rose 15% in the first half of 2024 and rates are expected to keep rising. Read More at : Big I | Independent Agents

Inflation if affecting all companies. In response they have all created pages to share what is causing rate increases.

Additonal Information:

-

- Auto Insurance Costs Soar Across the US

- Average Cost Increase 17.8% of Auto Insurance. Ohio is the 6th least expensive auto insurance carrier in the US

- Car insurance premiums around the U.S. are soaring. Here's why.

- American Drivers Can't Catch A Break

- America's Car Insurance Crisis Is Getting Worse